You will have heard about “robo-advisors” like Betterment and Wealthfront. Robo-advisors are funding corporations that use laptop algorithms to speculate your cash (“robo” refers to a pc investing for you versus an costly adviser).

You’re in all probability questioning if they’re a great funding and for those who ought to use one. As a NYT best-selling writer on private finance, let me break it down for you.

NOTE: For those who’re in search of extra data on investing, I like to recommend testing these different articles I wrote:

OR, make it simple on your self, and simply enter your electronic mail to get my Final Information To Private Finance under.

Why Robo-Advisors Grew to become Widespread

Robo-advisors took the elite monetary planning providers provided to shoppers of monetary advisers and full-service funding corporations like Constancy and made them accessible to the common individual.

You know the way Uber made personal vehicles extra accessible and handy than taxis? That’s type of what robo-advisors have performed to the funding trade.

Robo-advisors carried out new expertise to supply funding suggestions for low charges. They improved the consumer interface so you’ll be able to enroll on-line, reply just a few questions, and know precisely the place to speculate your cash in a couple of minutes.

And so they customized the expertise so you’ll be able to add in your targets—like while you wish to purchase a house—and robotically allocate cash apart for it.

Are Robo-Advisors a great Funding?

I’ve a powerful opinion on robo-advisors:

Whereas they’re good choices, I don’t assume they’re definitely worth the prices, and I imagine there are higher choices.

For example, I particularly selected Vanguard and have caught with them for a few years.

Let me clarify the professionals and cons of robo-advisors so you may make your personal determination.

Execs & Cons Of Robo-Advisors

Execs To Utilizing A Robo-Advisor

In the previous couple of years, robo-advisors have grow to be more and more well-liked for 3 causes:

■ Ease of use. They’ve lovely interfaces on the internet and in your telephone. They provide low minimums and make it simple to switch your cash over and get began investing.

■ Low charges. Generally, their charges began off decrease than these of full-featured funding corporations like Constancy and Schwab. (These corporations shortly realized their competitors and lowered their charges accordingly, whereas the charges at low-cost corporations like Vanguard have all the time been low.)

■ Advertising claims. Robo-advisors make a lot of advertising and marketing claims. Some are true, comparable to their ease of use. Some are disingenuous, bordering on absurd, like their deal with “tax-loss harvesting.”

As you’ve in all probability realized for those who’ve learn any of my different weblog content material on private finance, I’m an enormous proponent of something that expands the usage of low-cost investing to peculiar folks.

Lengthy-term investing is a crucial a part of dwelling a Wealthy Life, so if firms can strip away complexity and make it simpler to get began—even charging a usually low charge—I’m a fan.

These robo-advisors have added phenomenal options which are genuinely useful, together with planning for medium-term targets like shopping for a home and long-term targets like retirement.

What’s extra, you’ll be able to usually inform how good one thing is by who hates it.

For instance, Financial institution of America hates me as a result of I publicly name them on their bullshit. Good! Within the case of robo-advisors, commission-based monetary advisers usually hate them as a result of they use expertise to realize what many advisers have been doing—however cheaper.

Advisers’ logic on this isn’t particularly compelling. Monetary advisers primarily say that everybody is totally different they usually want particular person assist, not one-size-fits-all recommendation (unfaithful— relating to their funds, most individuals are principally the identical).

Robo-advisors have responded by including monetary advisers you’ll be able to speak to over the telephone. Conventional monetary advisers say their recommendation gives worth past the mere returns. (My response: High quality, then cost by the hour, not as a proportion of property below administration.)

Robo-advisors emerged to serve an viewers that was beforehand ignored:

younger people who find themselves digitally savvy, upwardly prosperous, and don’t wish to sit in a stuffy workplace getting lectured by a random monetary adviser.

Consider an worker at Google who doesn’t know what to do with their cash, which is simply sitting in a checking account. Robo-advisors have performed a great job of interesting to that viewers.

However the actual problem right here is “Are they price it?”

My reply is not any—their charges don’t justify what they provide. The most well-liked robo-advisors have excellent consumer interfaces, however I’m not prepared to pay for that. Since they opened, many robo-advisors have dropped their charges, generally even decrease than Vanguard.

The Drawback With Robo-Advisors

However there are two issues with that: With a purpose to run a sustainable enterprise on charges decrease than 0.4 %, they’ve to supply new, costlier options and handle huge quantities of cash—we’re speaking trillions of {dollars}.

For example, Vanguard presently manages 9 occasions greater than Betterment and ten occasions extra property than Wealthfront. That sheer, huge scale is a big aggressive benefit to Vanguard, which constructed itself over a long time to maintain on tiny fraction-of-a-percentage charges.

New robo-advisors can’t maintain on these low charges except they develop their enterprise quickly, which is unlikely. As an alternative, they’ve raised cash from enterprise capital traders, who need speedy progress.

With a purpose to appeal to extra prospects, robo-advisors have begun utilizing advertising and marketing gimmicks like highlighting a minuscule a part of investing, “tax-loss harvesting”—which is principally promoting an funding that’s all the way down to offset tax positive aspects—that they blew up right into a seemingly critically essential a part of an account.

Why Tax Loss Harvesting Isn’t That Necessary

This is able to be like a automobile producer spending tens of millions of {dollars} advertising and marketing a triple coat of paint as some of the essential components of shopping for a automobile. Certain, tax-loss harvesting would possibly prevent a little bit cash over the long run . . . however not so much.

And in lots of instances, it’s pointless. It’s a “good to have” function, however hardly one thing on which it’s best to base the essential determination of selecting what agency to speculate your cash with.

Some robo-advisors have additionally begun providing merchandise with greater charges, because the Wall Road Journal reported in 2018.

Wealthfront added a higher-cost fund of its personal. The providing makes use of derivatives to duplicate a preferred hedge fund technique generally known as “risk-parity.”

Some shoppers—joined by client advocates and rivals—shortly took to on-line boards to criticize the fund’s prices and complexity. Additionally they took Wealthfront to process for robotically enrolling sure prospects within the fund.

“I simply checked out my account & it’s true. There was cash moved into your ‘Threat Parity’ fund with out my consent,” Wealthfront buyer Cheryl Ferraro, 57 years previous, of San Juan Capistrano, California, just lately posted on Twitter.

“I had to enter my account and inform them I wished my cash moved out of that fund. It shook my confidence in them for certain,” Ms. Ferraro mentioned in an interview.

That is the predictable final result when a low-cost supplier raises enterprise capital and must develop quickly. It both finds extra prospects or finds a manner to earn more money from every buyer.

The Backside Line

I imagine Vanguard has the sting, and I make investments by means of them.

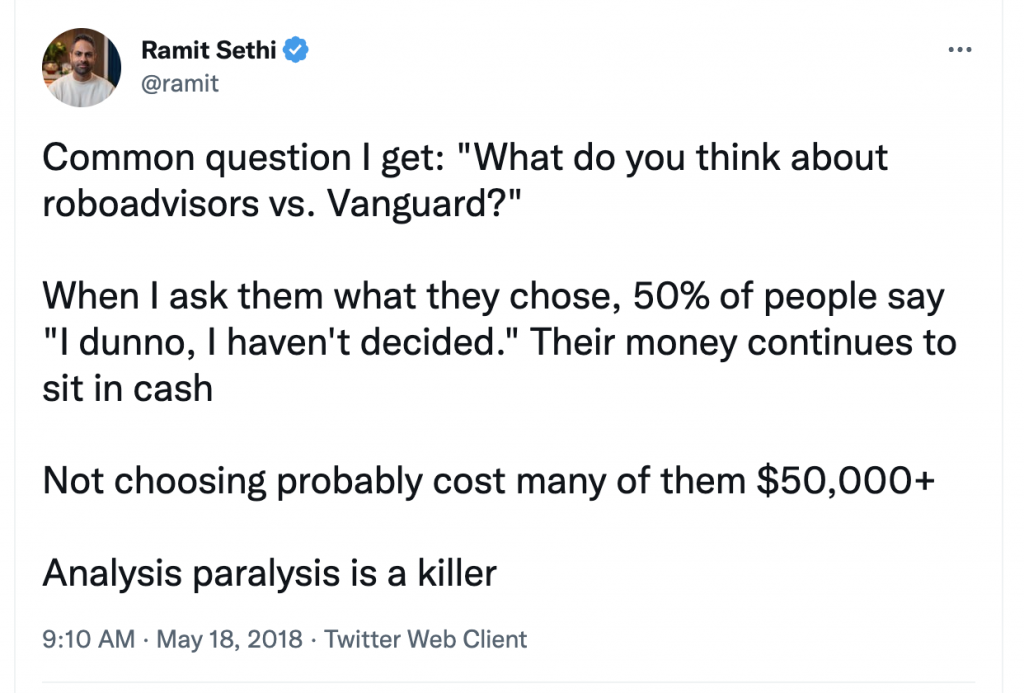

However understand this: By the point you’ve narrowed down your investing determination to a low-cost supplier like Vanguard or a robo-advisor, you’ve already made a very powerful alternative of all: to begin rising your cash in long-term, low-cost investments.

Whether or not you select a robo-advisor or Vanguard or one other low-fee brokerage is a minor element. Choose one and transfer on.